A Russia ETF can provide targeted exposure to the Russian economy. Before buying shares, investors should learn how a Russia equity ETF works and the pros and cons of investing.

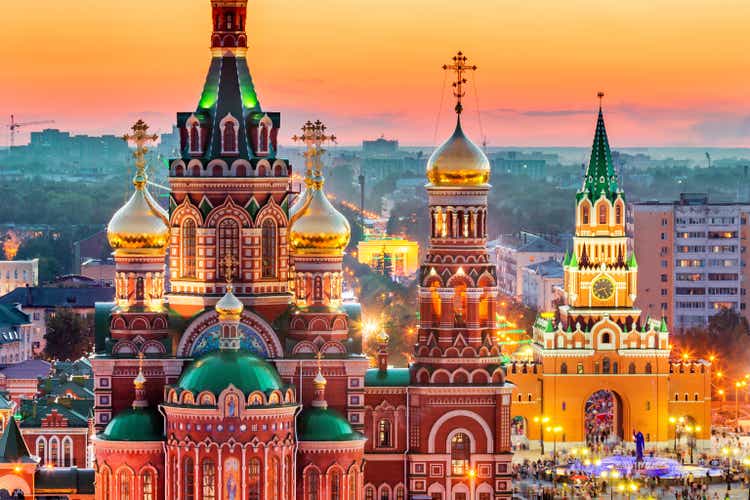

Mordolff/E+ via Getty Images

What Is A Russia ETF?

A Russia ETF is an exchange-traded fund that primarily invests in stocks of companies headquartered in Russia. There are 5 Russia ETFs that trade in the U.S., most of which passively track the performance of an index, such as the MSCI Russia 25/50 index, which is made up of 25 Russian large- and mid-sized companies.

When investors buy shares of a Russia ETF, they are buying a basket of Russian stocks that provide access to the Russian equity market. This specialization enables access to niche, country-specific areas of the market that may otherwise be inaccessible to most investors. As such, Russian ETF stock funds may offer investors a means of geographically diversifying an investment portfolio.

As of 2020, the Russian economy was ranked number 11 in the world, making it one of the largest global economies. The main industries in Russia include oil and gas, mining, precious metals, aerospace production, weapons and military machinery manufacturing, and agriculture.

Warning: As of March 1, 2022, Russia’s economy had been severely impacted by economic sanctions resulting from its invasion of Ukraine. The Russian Ruble fell to its all-time historic low, compared to the US dollar, and the Moscow Stock Exchange had been closed for two days. While US-based ETFs are generally not at risk of closure or default, the extreme circumstance surrounding the Russian economy and stock exchange is unprecedented in the history of ETFs. Therefore, investors should use extreme caution with regard to Russia ETFs at this time. Going forward, investors should also note that Russia is an emerging markets country, which means that their economy may maintain some characteristics of a developed market but hasn't yet met the standards of one.

Russian ETFs List

While there are many emerging markets ETFs that provide limited exposure to Russia stocks, there are only five ETFs that focus primarily on Russia. Four of the ETFs track different Russia stock indexes, and one is a leveraged ETF. Some investors seek a Russian dividend ETF because Russia stocks are often high-yielding.

iShares MSCI Russia Capped ETF

#1: iShares MSCI Russia Capped ETF (ERUS) seeks to track the investment results of the MSCI Russia 25/50 index, which consists of 25 stocks of Russian companies in a range of sectors and industries, primarily energy and materials. ERUS is the second-largest Russia ETF by assets but is the most widely traded by volume.

The ERUS ETF was formed on November 9, 2010 and is based in the United States. The index is a free float-adjusted market capitalization-weighted index that is designed to measure the performance of the large- and mid-capitalization segments of the Russian equity market. The fund is non-diversified.

VanEck Russia ETF

#2: VanEck Russia ETF (RSX) is an exchange-traded fund that seeks to replicate as closely as possible the price and yield performance of the MVIS Russia Index, which includes publicly traded companies that are incorporated in Russia or that are incorporated outside of Russia but must have at least 50% of their revenues or related assets in Russia.

Formed on April 24, 2007 the RSX ETF is the largest Russia ETF on the market, as measured by assets under management, and it is the first U.S.-based ETF to focus on Russia.

VanEck Small-Cap Russia ETF

#3: VanEck Small-Cap Russia ETF (RSXJ) is an exchange-traded fund that seeks to replicate as closely as possible the price and yield performance of the MVIS Russia Small-Cap Index, which includes securities of small-capitalization companies that are incorporated in Russia or that are incorporated outside of Russia but has at least 50% of their revenues or related assets in Russia.

The RSXJ ETF was formed on April 13, 2011 and is the only Russia ETF that focuses on Russian stocks with small capitalization. Small-cap stocks are generally stocks of companies with a market capitalization between $300 million and $2 billion.

Franklin FTSE Russia ETF

#4: The Franklin FTSE Russia ETF (FLRU) is an exchange-traded fund that seeks to provide investment results that closely correspond to the performance of the FTSE Russia Capped Index. FLRU has the lowest expense ratio among the list of Russia ETFs.

The FLRU ETF was formed on February 6, 2018 and is domiciled in the United States. The Index is comprised of large- and mid-sized companies in Russia. Under normal market conditions, the fund invests at least 80% of its assets in the component securities of the FTSE Russia Capped Index and in depositary receipts representing such securities.

Direxion Daily Russia Bull 2X Shares ETF

#5: The Direxion Daily Russia Bull 2X Shares ETF (RUSL) is a leveraged exchange-traded fund that uses financial derivatives to seek daily investment results of 200% of the performance of the MVIS Russia Index which invests in Russian stocks. There is no guarantee that the fund will achieve its stated investment objective.

Warning: Leveraged ETFs pursue daily leveraged investment objectives which means they are riskier than ETFs that do not use leverage. A leveraged ETF uses financial derivatives and debt as leverage to amplify the returns of an underlying index. The typical ETF attempts to match the returns of the index over time; however, a leveraged ETF attempts to double or triple the daily returns of the index.

Pros & Cons of Investing in Russian Market ETF

Before considering an investment in Russia ETFs, investors should carefully consider the pros and cons of investing.

Pros:

- Diversification: Russia ETFs offer the opportunity to geographically diversify a portfolio.

- Growth Potential: Emerging markets such as Russia have potential to have periods of accelerated growth.

- Access to Russia Market: Russia ETFs provide investors with exposure to Russia stocks that might otherwise be inaccessible to a U.S. investor.

Cons:

- Equity Risk: Equity investments carry the risk of price fluctuations.

- Currency Risk: Investing in foreign companies exposes an investor to potential losses arising from unfavorable fluctuations in exchange rates.

- Political Risk: Investing in foreign stocks, especially in emerging markets like Russia, can introduce added risk because their political systems are generally less stable. At the time of writing this article (2022), Russia is attempting to imperialize neighboring countries so political risk is very high.

Current Political Risk of Investing in Russian Market ETF

Political risk, or geopolitical risk, involves the probability that changes in the political landscape will negatively affect the investment. The current political risk of investing in a Russian market ETF is more pronounced compared to other emerging markets countries like Brazil, Mexico or South Africa.

Current political risk of investing in Russia ETFs include:

- Political Instability: Includes a possible change in government or unpredictability of political leaders, such as Vladimir Putin of Russia.

- Legal & regulatory constraints: Another indicator is the presence of legal and regulatory constraints, which have heightened with the recent Russia/Ukraine conflict.

- Tariffs and import/export restrictions: These restrictions, including punishing economic sanctions, make it more difficult to do business with companies within the country.

- Labor Unrest: If employees are not happy with the work environment, or a declining Russian economy due to economic sanctions, there could be strikes leading to supply issues.

- Morality issues: A significant portion of investors may not want to support Russian companies during the current time. This could lead to downward pressure of Russian asset prices. Investors should think very carefully before prioritizing potential profits over deeper values.

Bottom Line

Russia ETFs offer investors targeted exposure to stocks of companies based in Russia. While these ETFs can provide a means of diversifying a portfolio with country-specific access, investors should carefully weigh the pros and cons of investing in Russia and other emerging markets economies. At the current time, political instability is a significant risk for investors to consider.